Credit cards can be very useful, but they often have credit card fees that can add up fast. If you’re not careful, these fees can quickly become a big problem.

Missing a payment, going over your credit limit, or getting cash advances can lead to unexpected charges. To use your credit card wisely and save money, it’s key to know about the hidden charges that come with them.

By knowing about these possible charges, you can take steps to avoid hidden fees. This way, you can manage your credit card better.

Key Takeaways

- Understand the different types of credit card fees associated with your card.

- Review your credit card agreement to know what fees apply.

- Make timely payments to avoid late fees.

- Keep track of your spending to avoid exceeding your credit limit.

- Use your credit card responsibly to minimize additional charges.

Understanding Credit Card Hidden Fees

Understanding the fine print of credit cards is key to avoiding surprise charges. Credit card companies often hide fees in the terms and conditions. It’s important to stay alert.

What Constitutes a “Hidden” Fee

Hidden fees are charges that aren’t clear when you first get a credit card. These can include annual fees, late payment fees, and foreign transaction fees. Knowing about these fees helps you manage your credit card better.

Why Credit Card Companies Charge These Fees

Credit card companies charge hidden fees to make more money. These fees add up, especially if you don’t know about them or can’t avoid them.

The Impact of Hidden Fees on Your Finances

Hidden fees can have a big impact on your finances. Unexpected charges can increase your debt and financial stress. It’s important to understand these fees to use your credit card wisely.

| Type of Fee | Description | Potential Impact |

|---|---|---|

| Annual Fee | Charged once a year for card maintenance | Increased annual costs |

| Late Payment Fee | Charged for missing payment deadlines | Additional debt and interest |

| Foreign Transaction Fee | Charged for transactions in foreign currencies | Increased costs when traveling abroad |

Common Types of Credit Card Fees in Finland

Using a credit card in Finland can lead to various fees. These fees can add up fast. It’s important to understand them to manage your money well.

Annual Fees and Maintenance Charges

Many credit cards in Finland have annual fees. These fees can be a few euros or several hundred euros. It depends on the card’s benefits and rewards. Some cards also have monthly or quarterly maintenance charges.

Foreign Transaction Fees

Traveling abroad or buying online in foreign currencies can lead to foreign transaction fees. These fees are a percentage of the transaction amount. They can add up quickly.

Balance Transfer Fees

Transferring debt from one card to another can have balance transfer fees. These fees are usually a percentage of the amount transferred. They can be a big cost.

Cash Advance Fees

Withdrawing cash with your credit card can have cash advance fees. These fees are often higher than regular transaction fees. They also come with higher interest rates.

Knowing about these common credit card fees in Finland can help you make better financial choices. It can also help you save money.

The True Cost of Late Payment Fees

Late payment fees are more than just extra money. They can hurt your finances for a long time. Missing a payment deadline means you’ll face a fee and risk lowering your credit score.

Standard Late Payment Charges in Finland

In Finland, late fees range from €25 to €41. These fees can quickly pile up. This makes it harder to catch up on payments.

How Late Payments Affect Your Credit Score

Late payments can really hurt your credit score. They get reported to credit bureaus. A lower score means you might not get credit easily and could face higher interest rates.

Finnish Credit Reporting System

The Finnish system tracks your payment history. This includes any late payments. Your score is based on this history, which lenders use to decide if they’ll lend to you.

Long-term Consequences of Payment Delinquency

Repeating late payments can cause big problems. You might see your credit score drop, face higher interest rates, and even deal with debt collectors. It’s key to fix payment issues fast to avoid these issues.

Knowing the real cost of late fees and how they affect your credit score helps. You can then avoid these fees and keep your finances healthy.

Over-Limit Fees: What You Need to Know

Learning about over-limit fees can save you money. These fees happen when you go over your credit limit. It’s key to know about them to handle your credit card well.

How Over-Limit Fees Work in Finnish Credit Cards

In Finland, if you spend more than your credit limit, you might face over-limit fees. These fees can be high. So, it’s important to keep track of your spending and your limit.

Finnish Regulations on Credit Limits

Finnish laws make sure you know about over-limit fees. They tell you when and why you’ll be charged. This helps you use your credit card wisely.

Setting Up Alerts to Prevent Exceeding Your Limit

To dodge over-limit fees, set up alerts on your card. Many Finnish banks let you do this through their apps. They’ll tell you when you’re close to your limit.

| Bank | Alert Service | Over-Limit Fee |

|---|---|---|

| Nordea | Available | €25 |

| Danske Bank | Available | €30 |

| OP Bank | Available | €28 |

By understanding over-limit fees and using alerts, you can manage your credit card better. This way, you can avoid extra charges.

Balance Transfer Fee Traps to Watch For

Balance transfers can save you money on interest. But, they have their own traps. It’s key to know the fees and terms of the new card before transferring.

Promotional Rates vs. Long-Term Costs

Credit cards often have special rates for balance transfers. These rates can be as low as 0% for a while. But, these rates are only temporary.

After the special period ends, rates can go up a lot. For example, some Finnish banks offer rates for 6 to 12 months. Then, rates can jump to 20% or more.

Calculating the True Cost of a Balance Transfer

It’s important to figure out the real cost of a balance transfer. This includes the balance transfer fee, which can be 3% to 5% of the amount moved. For example, moving €1,000 could cost €30 to €50 in fees.

You should also think about the interest rate after the special period ends.

Finnish Banks with Competitive Balance Transfer Options

Some Finnish banks have good balance transfer options. For example, Nordea and Danske Bank offer cards with great rates and low fees. Always compare and read the fine print to find the best deal.

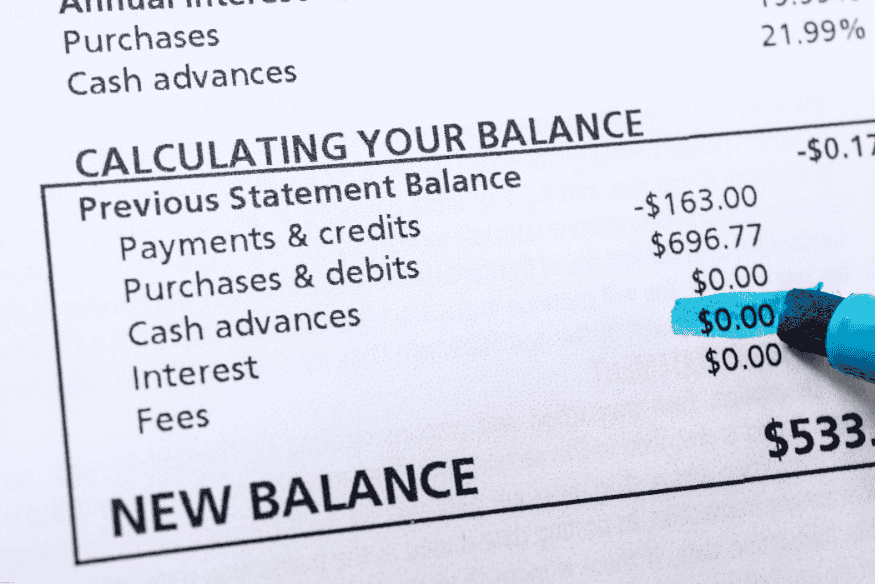

How to Avoid Hidden Fees on Your Monthly Statement

Checking your credit card statement every month is key to avoiding hidden fees. Your statement shows all your transactions, fees, and charges. By understanding your statement, you can spot any wrong or extra charges.

Reading Your Statement Effectively

To understand your statement well, focus on areas that might show hidden charges. Here are important sections to look at:

Key Areas to Review Each Month

- Transaction List: Make sure each transaction is correct and recognized.

- Fee Section: Look for any fees, like late fees, foreign transaction fees, or balance transfer fees.

- Interest Charges: Know how interest is figured and check if it’s right.

Red Flags That Indicate Hidden Charges

Watch for strange transactions, duplicate charges, or fees you don’t get. If something looks off, dig deeper.

Spotting Unexpected Charges

Hidden charges can be in the fine print or hidden in a list of transactions. To find these, carefully check your statement for:

- Foreign transaction fees even if you didn’t travel abroad, as some transactions might be processed internationally.

- Balance transfer fees if you’ve transferred a balance recently.

- Late fees if you’ve missed a payment or paid late.

| Fee Type | Description | How to Avoid |

|---|---|---|

| Foreign Transaction Fee | Fee charged for transactions processed abroad | Use a credit card with no foreign transaction fees |

| Late Payment Fee | Fee charged for late payments | Set up automatic payments to ensure timely payments |

| Balance Transfer Fee | Fee charged for transferring a balance | Choose a credit card with low or no balance transfer fees |

Disputing Incorrect Fees with Finnish Banks

If you find any wrong or hidden fees, contact your bank right away. Finnish banks usually listen to customer complaints and can fix fee issues. Keep records of your talks and be ready to show proof of your claim.

By being proactive and checking your statement often, you can dodge hidden fees and pay less on your credit card.

Foreign Transaction Fees When Traveling

Traveling abroad can be expensive if you don’t know about foreign transaction fees. These fees can make your trip cost more than you expected.

How Much You’re Really Paying Abroad

Foreign transaction fees are usually between 1% and 3% of the purchase amount. For example, buying something worth €100 with a 2% fee adds €2 to your bill. These fees can add up fast, especially if you travel a lot or make many purchases.

Finnish Cards with Reduced Foreign Transaction Fees

Some Finnish credit cards have lower or no foreign transaction fees. This makes them great for traveling abroad. For instance, Nordea’s Visa Card and OP’s Visa Platinum have good fees. Always check with your bank to see if they offer these benefits.

| Credit Card | Foreign Transaction Fee |

|---|---|

| Nordea’s Visa Card | 0% |

| OP’s Visa Platinum | 0% |

| Danske Bank’s Visa Card | 1.5% |

Currency Conversion Traps to Avoid

Watch out for currency conversion traps like dynamic currency conversion (DCC). Merchants might convert your purchase to your home currency, adding extra fees. Always choose to be charged in the local currency to avoid these fees.

Cash Advance Fees and Interest Rates

In Finland, it’s key to know about cash advance fees and interest rates. This knowledge helps you manage your credit card costs better. Cash advances offer quick cash but come with big costs.

Why Cash Advances Are Expensive

Cash advances are pricey because of high fees and rates. The rates for cash advances are usually higher than for regular purchases. Interest starts right away, making borrowing costs rise fast.

Alternatives to Cash Advances in Finland

Looking at other options can help you avoid high fees. In Finland, you might find personal loans or emergency credit with lower rates and fees. Exploring these alternatives is a good idea before choosing a cash advance.

Emergency Options with Lower Fees

| Option | Interest Rate | Fees |

|---|---|---|

| Personal Loan | 6% – 12% | Low origination fees |

| Emergency Credit | 8% – 15% | No hidden fees |

| Cash Advance | 20% – 30% | High transaction fees |

By comparing these options, you can choose the best way to get emergency funds in Finland.

Negotiating with Your Credit Card Company

Knowing your rights can help you negotiate fee waivers with your credit card company. This can save you money on hidden fees. It’s all about understanding when and how to ask.

When and How to Request Fee Waivers

If you think a fee is unfair, call your credit card company. Explain your situation and mention your loyalty. The best time to call is after a big payment or when you’ve reached a milestone.

Leveraging Customer Loyalty

Your history with the credit card company can help. If you’ve always paid on time, remind them. Companies like to keep loyal customers and might waive fees to keep you.

Finnish Consumer Protection Laws That Support You

Finnish laws protect consumers from unfair practices. Learn about these laws to know your rights. For example, some fees are unfair if not clearly stated.

| Consumer Right | Description | Benefit |

|---|---|---|

| Clear Disclosure | Credit card companies must clearly disclose all fees. | Avoids surprise charges. |

| Fair Practice | Companies are prohibited from unfair practices. | Protects consumers from exploitation. |

| Right to Complain | Consumers have the right to complain about unfair fees. | Empowers consumers to dispute charges. |

Selecting Fee-Friendly Credit Cards in Finland

Finding a credit card that fits your budget and avoids extra fees is key in Finland. There are many choices, so it’s important to compare them well. This helps avoid spending more than you need to.

Cards with Minimal Annual Fees

Some credit cards in Finland have little or no annual fees. This makes them great for saving money. Nordea and OP Bank are Finnish banks that offer such cards. Always check the fine print to know about any hidden costs.

Rewards Cards That Offset Fee Costs

Rewards credit cards can help pay for their fees. You earn points or cashback, which can cover the costs. For example, credit card offers from Finnish banks often include rewards that reduce fees.

Comparing Credit Card Offers from Finnish Banks

It’s vital to compare credit card deals from different Finnish banks. Banks like Nordea, OP Bank, and Danske Bank have various cards. Each has its own fees and benefits.

Nordea Options

Nordea has many credit cards, some with no annual fees. Their cards also have good interest rates and rewards.

OP Bank Credit Cards

OP Bank is known for being customer-friendly. Their credit cards have low fees and nice rewards.

Danske Bank Alternatives

Danske Bank also has many credit card choices. They offer cards with good fees and rewards. Comparing them with Nordea and OP Bank can help you find the best card for you.

By looking closely at the features and fees of these Finnish bank cards, you can choose wisely. This way, you can pick a card that saves you money.

Digital Tools to Track and Avoid Credit Card Fees

Using digital tools is a smart way to keep track of your credit card spending and avoid extra fees. In Finland, you can find many digital tools to help manage your credit card fees well.

Finnish Banking Apps with Fee Alerts

Many Finnish banks have mobile apps that send fee alerts. This way, you can know about any charges on your credit card right away. For example, Nordea and OP have apps that tell you about any fees on your credit card.

| Bank | App Name | Fee Alert Feature |

|---|---|---|

| Nordea | Nordea Mobile Banking | Yes |

| OP | OP Mobile Banking | Yes |

| Danske Bank | Danske Mobile Banking | Yes |

Third-Party Financial Management Tools

You can also use third-party tools to watch your credit card spending. Apps like Mint and YNAB (You Need a Budget) help you track your spending. They also send alerts for potential fees.

Setting Up Automatic Payments to Avoid Late Fees

Setting up automatic payments is a great way to dodge late fees. Most Finnish banks let you set up automatic payments through their apps or online. This way, you can make sure your credit card bills are paid on time, every time.

Conclusion

Understanding and avoiding hidden fees can help you get the most from your credit card. It’s key to know the fees your card has and use it wisely.

Use digital tools to keep track of your spending and check your statements. This helps you catch any unexpected charges. Many Finnish apps even send alerts for potential fees.

Look for credit cards with low or no annual fees. Rewards cards can also help by offering benefits that make up for fees. These tips can help you enjoy your credit card without worrying about extra costs.

Being smart about your credit card use can save you money. It’s all about being aware and taking steps to avoid hidden fees. This way, you can use your financial resources more effectively.