Using a credit card for online purchases can be both safe and convenient—if you understand the essentials. In fact, many financial experts agree that online shopping with credit options are often safer than using debit cards, especially when it comes to fraud protection and dispute resolution.

When you make online purchases using a credit card, you’re typically shielded from unauthorized transactions. Most major credit card issuers offer built-in protections, such as zero-liability policies, real-time fraud alerts, and advanced encryption technologies. These features help ensure that your personal and financial data remain secure.

Still, being proactive about your online safety is just as important as choosing the right credit card. Smart habits can significantly reduce your exposure to risk while shopping online.

Key Takeaways

- Choose a secure connection when making online transactions.

- Verify the authenticity of the website before entering your credit card details.

- Use a strong and unique password for your credit card account.

- Monitor your credit card statements regularly for suspicious activity.

- Keep your credit card information up to date and secure.

The Growing Importance of Safe Online Shopping

As online shopping continues to rise in popularity, the need for secure transactions is more critical than ever. With just a few clicks, you can browse your favorite stores, compare prices, and make purchases without leaving your home. But this convenience also brings the responsibility of safeguarding your financial data.

Across many countries, especially those with strong digital infrastructure, online shopping with credit has become a key tool in ensuring safe and reliable e-commerce experiences.

E-commerce Growth and Consumer Behavior

The rapid growth of e-commerce in recent years has transformed how people shop. Consumers are increasingly turning to online platforms for everything—from groceries to electronics. This shift is largely driven by improved digital services, widespread internet access, and growing trust in digital transactions.

With this growth comes a stronger focus on security. Both retailers and consumers are investing more in tools and habits that protect financial data, making safe online shopping with credit usage a top priority.

Why Credit Cards Are Preferred for Online Purchases

Credit cards remain the most preferred payment method for online shopping—and for good reason. One of the biggest advantages of online shopping with credit is the enhanced protection it offers. Most credit card issuers provide:

- Fraud monitoring with real-time alerts.

- Zero-liability policies for unauthorized charges.

- Dispute resolution services in case of transaction issues.

Beyond security, credit cards often offer extra perks like cashback rewards, loyalty points, and purchase protection, making them a smarter choice for frequent online shoppers.

By using your online shopping with credit responsibly, you can take advantage of these benefits while minimizing risks. The right credit card not only offers financial flexibility but also peace of mind when navigating the digital marketplace.

Benefits of Using Online Shopping Credit

Online shopping with credit comes with a range of valuable advantages, making your purchases not only more secure but also more rewarding. Whether you’re buying essentials or splurging on something special, using a credit card can enhance your overall experience.

Purchase Protection and Fraud Coverage

One of the biggest benefits of online shopping with credit is the built-in security. Credit cards typically offer superior purchase protection compared to other payment methods, especially debit cards. If a transaction goes wrong—such as receiving a damaged product, facing a shipping issue, or falling victim to fraud—your credit card issuer can intervene on your behalf.

Many cards include:

- Zero-liability policies for unauthorized transactions

- Dispute resolution services

- Chargeback support in case of unfulfilled or unsatisfactory orders

This added layer of protection helps you shop with confidence, knowing that your purchases and personal information are well-guarded.

Rewards and Cashback Opportunities

Another major perk of online shopping with credit is the opportunity to earn rewards. Many credit cards offer points, miles, or cashback for every purchase. Some even provide bonus rewards in specific categories like dining, travel, or groceries—perfect for maximizing the value of your spending.

These rewards can be used to:

- Offset future purchases

- Reduce your monthly balance

- Redeem for travel, merchandise, or gift cards

In addition to rewards, premium credit cards often include extra benefits like travel insurance, extended warranties, and concierge services, giving you even more value with each transaction.

Choosing the right credit card tailored to your shopping habits can significantly enhance your financial return while keeping your online transactions safe.

Understanding Credit Card Security Features

To ensure your online purchases are secure, it’s essential to understand the key security features built into credit cards. These technologies are designed to protect your financial information and significantly reduce the risk of fraud during online transactions.

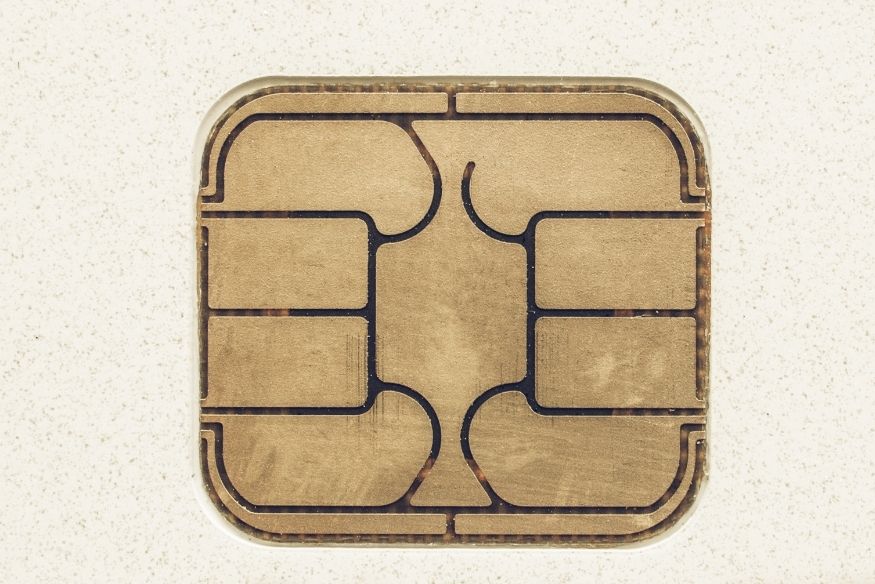

Chip Technology and Tokenization

Modern credit cards are equipped with EMV chip technology, which creates a unique transaction code for every purchase. Unlike the magnetic stripe, the chip ensures that your card details cannot be easily cloned or reused by fraudsters.

Tokenization adds another layer of protection by replacing your actual card number with a randomly generated token during online transactions. This means that even if the tokenized data is intercepted, it cannot be used to complete unauthorized purchases.

CVV Codes and Their Purpose

The Card Verification Value (CVV) is a three- or four-digit number printed on your card, separate from your card number. It serves as a security check to confirm that you physically possess the card during online purchases.

Because merchants are prohibited from storing the CVV code, it remains protected even if their databases are compromised—adding another barrier against fraudulent transactions.

Two-Factor Authentication Methods

Two-factor authentication (2FA) strengthens your online shopping security by requiring two different types of identification:

Something you know (like a password)

Something you have (like a one-time code sent to your mobile phone)

Many banks and card issuers now use 2FA for online purchases, making it much harder for unauthorized users to complete a transaction—even if they have your card number.

Summary of Key Credit Card Security Features

| Security Feature | Description | Benefit |

|---|---|---|

| Chip Technology | Generates a unique code for each transaction | Reduces risk of card data reuse |

| CVV Codes | Verifies card possession during online transactions | Adds an extra layer of protection |

| Two-Factor Authentication | Requires two forms of identity verification | Significantly enhances transaction security |

Understanding and utilizing these security features helps you stay in control and protected while shopping online.

Choosing the Right Credit Card for Online Shopping

Selecting the right credit card for your digital purchases is essential. It not only helps you earn rewards and save money but also protects you from unnecessary fees and potential risks. With so many options available, it’s important to consider your spending habits, needs, and how often you shop online—especially across borders.

What to Look for in a Credit Card

When evaluating credit cards for online shopping with credit, focus on features that enhance both convenience and security. Key factors include:

- Purchase protection and fraud liability coverage

- Rewards or cashback on online purchases

- Low or no annual fees

- Competitive interest rates

- Mobile-friendly account management

Cards that offer extra rewards for online categories or digital purchases can maximize your returns over time.

Global Credit Card Options

Instead of focusing on cards from a single country, look for internationally accepted credit cards from major providers like Visa, Mastercard, or American Express. Many global banks and fintech companies offer cards tailored to online shoppers, with features like real-time spending notifications, virtual cards, and enhanced security settings.

These cards are typically compatible with global e-commerce platforms and provide better support for cross-border purchases.

International Purchase Considerations

If you frequently shop on international websites, be aware of additional charges and exchange rate issues that can increase the total cost of your purchases.

Foreign Transaction Fees

Some credit cards charge a foreign transaction fee, usually around 1% to 3%, on purchases made outside your home currency. Over time, this can add up significantly.

Tip: Choose a credit card that offers zero foreign transaction fees. This is especially valuable if you regularly buy from international sellers.

Currency Conversion Policies

Every credit card provider has its own way of handling currency conversion. Some offer more favorable exchange rates, while others may include hidden markup costs.

Before making an international purchase, check:

- Whether your card applies automatic currency conversion

- The exchange rate policy of your card issuer

- If there’s an option to pay in your local currency or the merchant’s currency

Understanding these details can help you make smarter decisions and avoid overpaying.

Essential Device Security Measures

Protecting the device you use for online shopping is just as important as choosing a secure payment method. No matter how safe your credit card may be, vulnerabilities on your phone, tablet, or computer can expose you to serious risks. Ensuring your device is equipped with the latest security features is a critical step toward safeguarding your personal and financial data.

Keeping Software and Browsers Updated

Always keep your operating system, browser, and all installed software up to date. Security updates are regularly released to fix known vulnerabilities that cybercriminals could exploit. Enabling automatic updates is a smart way to stay protected without needing to remember to check manually.

Outdated software is one of the most common entry points for malware and phishing attacks—especially on devices used for online shopping with credit.

Antivirus and Malware Protection

Invest in reputable antivirus and anti-malware software to create a strong line of defense against digital threats. A good security suite will:

- Detect and block malicious software in real time

- Prevent unauthorized access to sensitive information

- Scan your system regularly for hidden threats

Set your antivirus software to perform automatic scans and ensure it receives frequent updates so it can recognize the latest threats.

Secure Wi-Fi vs. Public Networks

Public Wi-Fi networks are convenient—but highly insecure. Hackers can easily intercept data on open networks, putting your login credentials and payment details at risk. To stay safe:

- Avoid making purchases on public Wi-Fi

- Use only password-protected home networks

- Consider using a Virtual Private Network (VPN), which encrypts your connection and hides your data from prying eyes

Using a secure network ensures that your information remains private when entering credit card details or logging into shopping accounts.

Summary of Essential Security Measures

| Security Measure | Description | Benefit |

|---|---|---|

| Software Updates | Keeping OS and software current | Fixes security vulnerabilities |

| Antivirus Software | Protects against malware and cyber threats | Prevents data theft |

| Secure Wi-Fi | Using encrypted, password-protected connections | Reduces risk of interception and spying |

Taking these steps protects not only your device but also your entire online shopping with credit experience.

Identifying Legitimate Online Retailers

One of the most important steps in safe online shopping is choosing reliable and secure online retailers. Even with strong device protection and a trusted credit card, your data can still be at risk if you shop on an unsecured or unverified website. Knowing how to recognize legitimate sellers helps you avoid scams, fraud, and poor shopping experiences.

Verifying Website Security

Before entering your credit card details or personal information, always verify that the website is secure. Look for:

- HTTPS in the URL — this indicates that the connection between your browser and the website is encrypted.

- A padlock symbol in the address bar — clicking it can reveal whether the site uses an active SSL certificate.

- A valid SSL certificate — which confirms the authenticity of the website and helps protect your information from interception.

These security indicators show that the website takes customer protection seriously.

Recognizing Secure Payment Symbols

Legitimate e-commerce sites often display secure payment verification symbols, such as:

- Visa Secure

- Mastercard Identity Check

- American Express SafeKey

- 3D Secure (3DS) authentication icons

These programs add an extra layer of security to your online shopping with credit, verifying both your identity and the transaction before processing the payment.

Researching Retailer Reputation

Always research a retailer before making a purchase—especially if it’s your first time shopping with them. Look for:

- Customer reviews and ratings on third-party platforms

- Better Business Bureau or other consumer protection agencies

- Return and refund policies listed clearly on the site

- Professional and responsive customer service options

Reading feedback from other buyers can give you insight into product quality, delivery reliability, and how well the company handles issues.

Trusted Global Online Marketplaces

While each region has its own preferred online retailers, these global marketplaces are widely recognized for their robust security practices and customer support:

| Trusted Marketplace | Security Features |

|---|---|

| Amazon | HTTPS, SSL, Buyer Protection, 2FA, Verified Sellers |

| eBay | HTTPS, SSL, Buyer Guarantees, Secure Payment Gateways |

| AliExpress | HTTPS, SSL, Escrow Services, Secure Checkout |

Sticking to well-known platforms that prioritize safety can greatly reduce the risk of fraud and improve your overall online shopping with credit experience.

Creating Strong Account Security

A secure online shopping experience begins with strong account protection. Even if you use a secure device and trusted credit card, weak login credentials can still expose you to cyber threats. Strengthening your account security ensures that your online shopping with credit remains safe from unauthorized access.

Password Management Best Practices

Creating and maintaining strong passwords is a fundamental step. Here’s how to do it effectively:

- Use a mix of uppercase and lowercase letters, numbers, and special characters.

- Avoid using predictable information like your name, birthdate, or common words.

- Change your passwords regularly to limit exposure over time.

- Use a password manager to securely store and generate complex passwords.

- Enable two-factor authentication (2FA) on all shopping and financial accounts for added protection.

These best practices help prevent brute force attacks and password leaks from compromising your accounts.

Unique Credentials for Different Retailers

Reusing the same login credentials across multiple websites is a major security risk. If one site suffers a data breach, hackers can potentially access your other accounts using the same information.

To prevent this:

- Use a unique username and password for every online retailer.

- Regularly review and update credentials, especially if a breach is reported.

Maintaining unique login credentials across platforms significantly strengthens your defense against cybercrime.

Monitoring Your Credit Card Activity

Another key element of safe online shopping with credit is actively monitoring your credit card account for unauthorized transactions. Early detection can prevent fraud from escalating and protect your financial wellbeing.

Setting Up Transaction Alerts

Most credit card providers offer real-time transaction alerts via SMS, email, or mobile app notifications. These alerts inform you immediately when:

- A purchase is made

- A charge exceeds a set amount

- Your card is used in a new location or online platform

You can activate these features by logging into your online banking dashboard or contacting your card issuer.

Regular Statement Reviews

Even with alerts in place, it’s essential to manually review your credit card statements every billing cycle. Scrutinize each charge to confirm its legitimacy. If anything looks unfamiliar or suspicious, act quickly.

Identifying and Reporting Suspicious Charges

If you detect any unauthorized or strange transactions, report them to your credit card company immediately. Most issuers offer 24/7 support and will guide you through:

- Blocking the card

- Reversing the fraudulent charge

- Issuing a new card number

Keep a record of all communications and confirmations for your protection.

Summary of Best Practices for Monitoring Credit Card Activity

| Best Practice | Description | Benefits |

|---|---|---|

| Transaction Alerts | Notifications for real-time credit card activity | Immediate updates on account use |

| Regular Statement Reviews | Manually checking statements for unauthorized charges | Early detection of suspicious transactions |

| Reporting Suspicious Charges | Alerting your issuer about fraud or errors | Quick resolution and account protection |

By combining strong account security with vigilant credit card monitoring, you can ensure that your online shopping with credit experience remains safe and worry-free.

Consumer Protection for Online Purchases

Consumers benefit greatly from strong legal protections when shopping online, especially in countries with well-established consumer rights frameworks. These protections ensure that online shopping with credit remains safe, fair, and transparent—both for domestic and international transactions.

Consumer Protection Laws: A Finnish Example

Finland provides an excellent model of how strict consumer laws can enhance e-commerce safety. The Finnish Consumer Protection Act guarantees several key rights for online shoppers, including:

- Clear and accurate product information before purchase

- The right to cancel an online order within a set timeframe (typically 14 days)

- Protection from unfair terms or hidden fees in contracts

These legal safeguards apply whether you’re shopping from a Finnish or international retailer, giving consumers confidence to buy online with fewer risks.

While this section focuses on Finland, similar consumer rights exist across many countries in Northern and Western Europe—ensuring secure and transparent online shopping experiences for residents.

Credit Card Company Policies and Buyer Protections

In addition to national laws, credit card issuers play a crucial role in protecting online shoppers. Most major credit card companies offer:

- Zero-liability policies, meaning you’re not held responsible for unauthorized charges

- Dispute resolution services for incorrect, missing, or damaged items

- Purchase protection, which may cover lost or stolen goods for a limited time

It’s important to review the terms and benefits of your credit card agreement to understand exactly what protections are included. Some cards also offer:

- Real-time transaction alerts

- Extended warranties on eligible purchases

- Return protection for online items that merchants won’t accept back

By combining legal consumer rights with robust credit card protections, shoppers can approach online shopping with credit more confidently—knowing they have multiple layers of support if something goes wrong.

Avoiding Common Online Shopping Scams

While online shopping with credit offers convenience and security, it’s still important to stay alert to potential scams. Cybercriminals continue to develop creative ways to trick online shoppers into sharing personal or financial information. Knowing how to recognize and avoid these scams is essential to protect your data and your money.

Phishing Attempts and Fake Websites

One of the most common online scams involves phishing and fake websites. These fraudulent sites are designed to look like legitimate retailers to trick you into entering your credit card details or login credentials.

Red Flags:

- URLs that contain extra characters or misspellings

- Missing “https” or padlock symbol in the browser bar

- Unexpected emails or pop-ups requesting sensitive information

Protection Tips:

- Always double-check the website address before making a purchase

- Look for security indicators such as SSL certificates and secure checkout badges

- Use bookmarks for trusted retailers instead of clicking on promotional links

For more detailed guidance, see Wells Fargo’s tips on online shopping scams.

Too-Good-To-Be-True Offers

If an online deal looks too good to be true, it probably is. Scammers often lure users with massive discounts or fake flash sales to collect payment without delivering products.

Red Flags:

- Prices that are significantly lower than other retailers

- Requests for payment via unusual methods (e.g., wire transfer or gift cards)

- Lack of verified reviews or return policy information

Protection Tips:

- Research the seller before buying, especially if the site is unfamiliar

- Read verified customer reviews on third-party platforms

- Avoid entering payment details unless you’re confident in the retailer’s legitimacy

Social Media Shopping Scams

Scammers increasingly use social media platforms to promote fake products or mimic legitimate brands. These scams often appear in sponsored ads, posts, or unsolicited messages.

Red Flags:

- Direct messages promoting limited-time offers or contests

- Ads with stolen product images or no company background

- Requests to complete payment outside the official platform

Protection Tips:

- Be cautious with unsolicited offers or messages from unknown sellers

- Only shop through verified brand accounts

- Never provide credit card or personal information in a private message

Common Online Shopping Scams at a Glance

| Scam Type | Red Flags | Protection Tips |

|---|---|---|

| Phishing Attempts & Fake Sites | Suspicious URLs, fake store design, personal info requests | Verify website address, look for “https”, avoid unknown links |

| Too-Good-To-Be-True Offers | Unrealistic discounts, pressure to pay upfront | Research seller, check reviews, avoid suspicious payment methods |

| Social Media Shopping Scams | Unsolicited posts/messages, no verified seller profile | Be cautious, only buy from trusted accounts, use secure payment methods |

By staying vigilant and informed, you can avoid falling victim to scams and enjoy a safer online shopping with credit experience.

Conclusion: Enjoying Secure Online Shopping with Credit

Having a safe and rewarding online shopping with credit experience is entirely possible when you follow the right practices. From understanding credit card security features to choosing the right card for your needs, each step contributes to greater peace of mind and protection.

Recent statistics show that nearly 70% of online shoppers prefer using debit or credit cards, citing convenience, security, and wide acceptance as the top reasons. In fact, advancements in payment technology have made a measurable impact—EMV chip implementation and secure authentication methods have helped reduce card fraud by 15% over the past three years.

At the same time, digital wallets like PayPal, Apple Pay, and Google Wallet have seen a 40% increase in adoption, offering even more secure and seamless checkout options for consumers worldwide.

To shop safely and confidently online:

- Choose a credit card with strong fraud protection and zero-liability policies

- Use secure networks and updated devices when making purchases

- Monitor your credit card activity for suspicious charges or unauthorized use

- Stay alert to scams and phishing attempts, especially on unfamiliar or social media platforms

By staying informed and proactive, you can significantly reduce risk and make the most of online shopping with credit—enjoying both the convenience and the rewards, without sacrificing safety.